An endowment can fund any area from a wide range of options. Give where you care, and help drive the difference you want to see.

An endowment is one of the most powerful ways you can support ASU.

You can create an endowed fund at ASU through the gift of an asset that is invested and managed by the ASU Foundation.

Continuous and reliable support

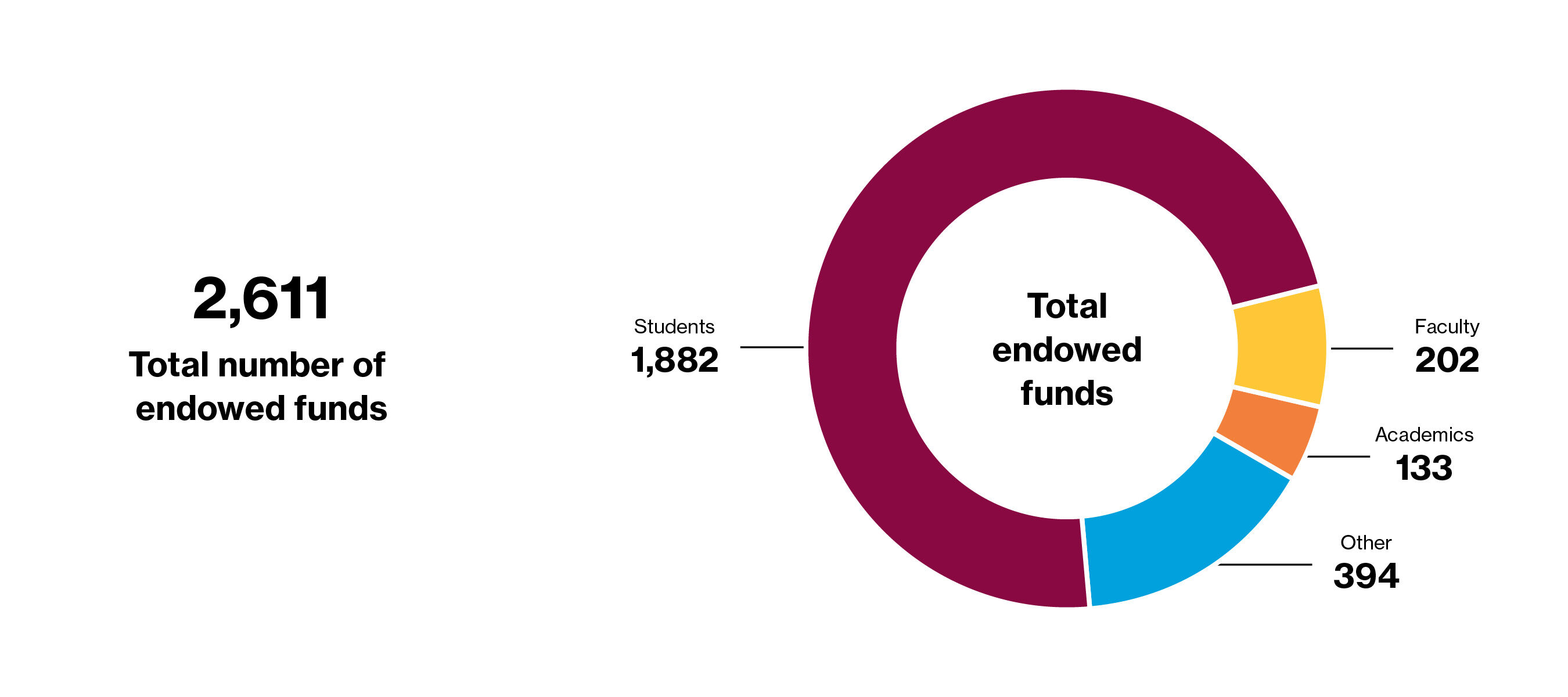

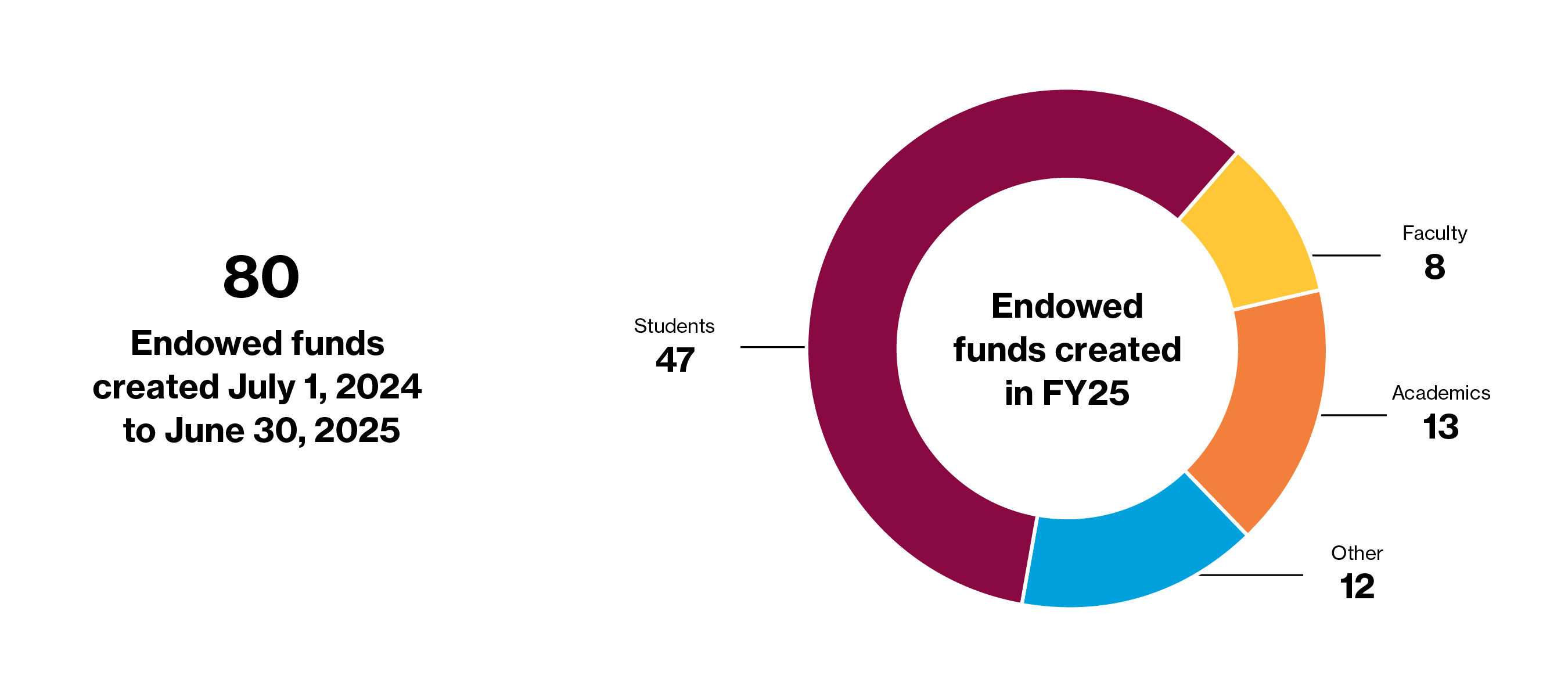

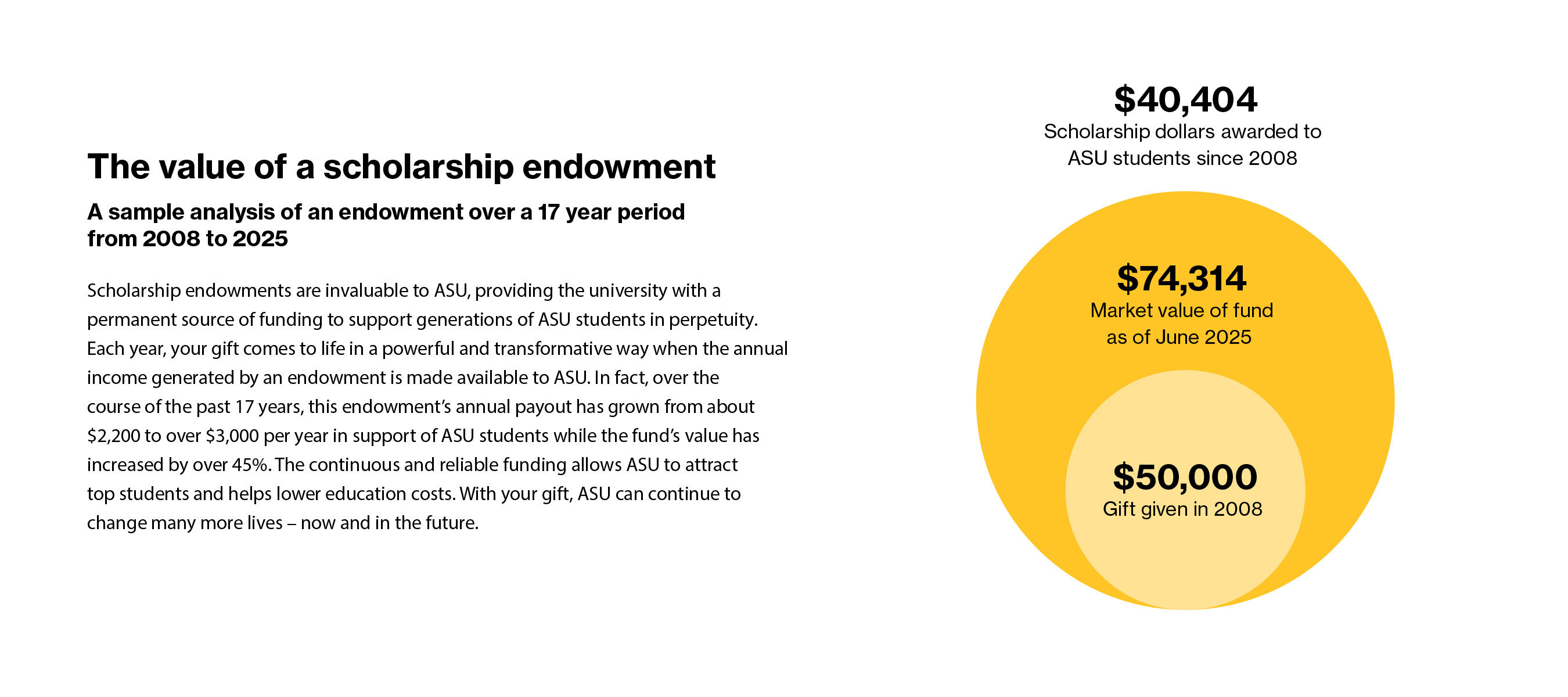

Payout generated by an endowment provides a continuous, reliable resource stream of revenue annually to your areas of passion at ASU. Endowed funds guarantee support to advance the ASU Charter, particularly as state and federal funding falls.

Long-term impact

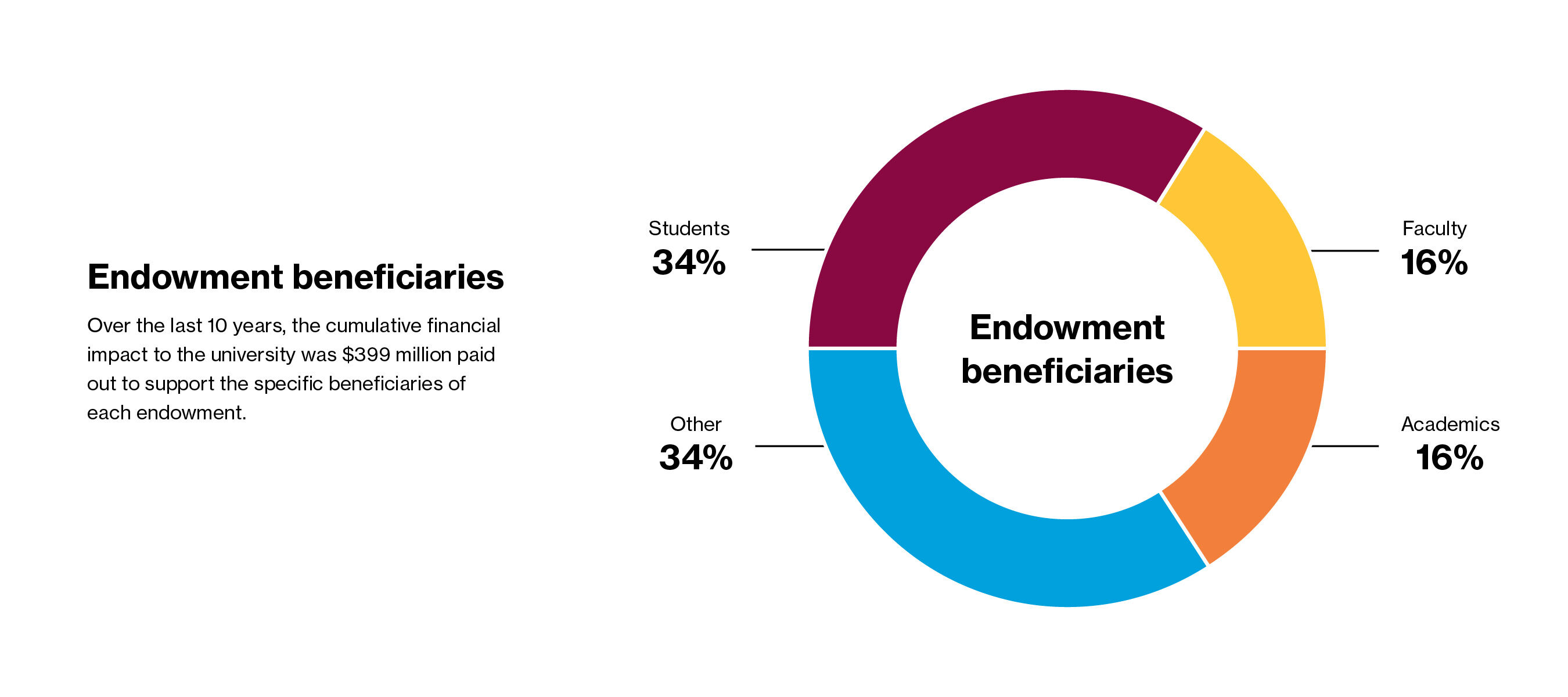

An endowed fund creates a lasting legacy. The principal remains intact while the generated income supports ASU's students, faculty, research and programs indefinitely. Your gift continues to make an impact year after year, ensuring sustainable support for generations to come.

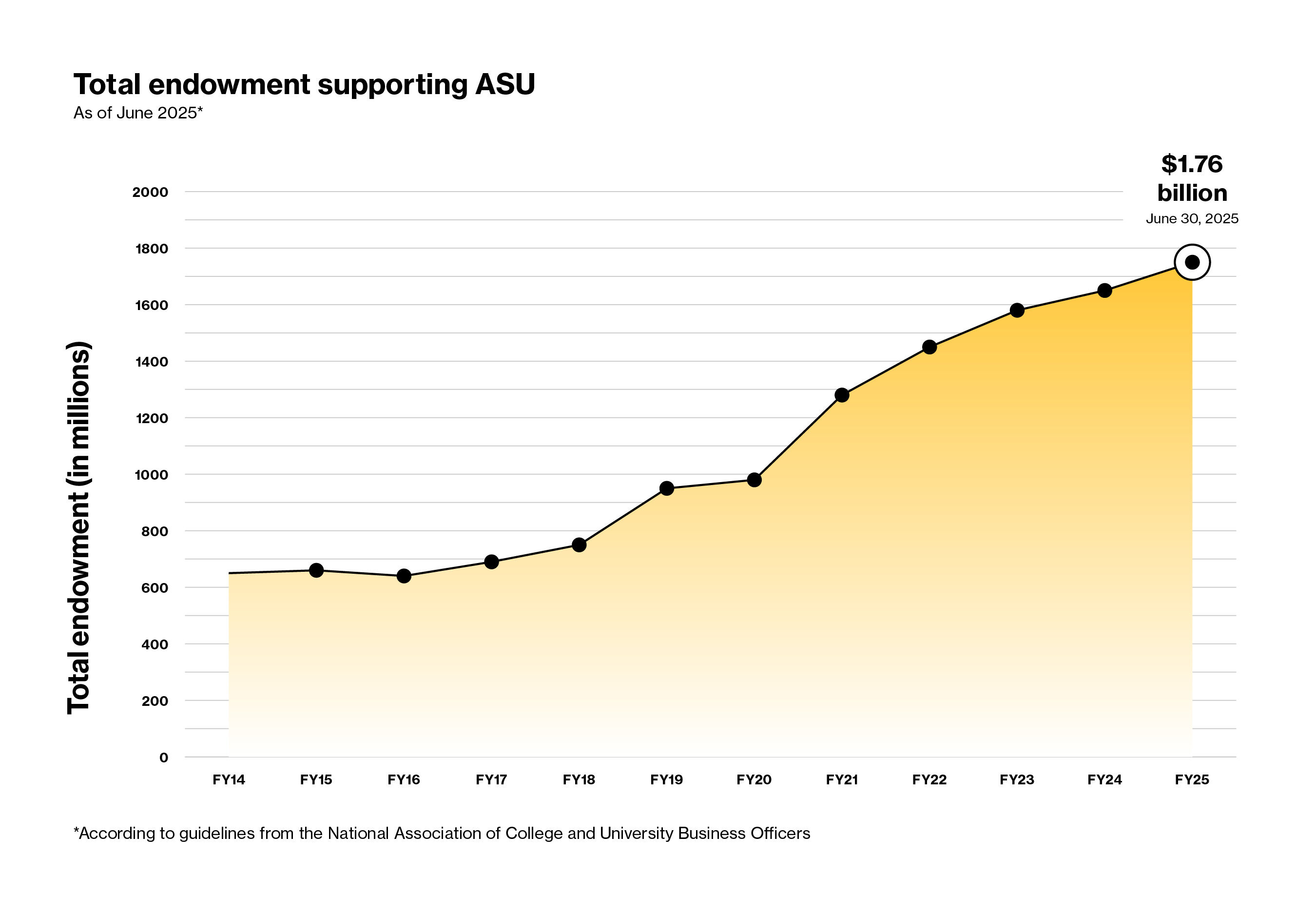

Growth fuels the future

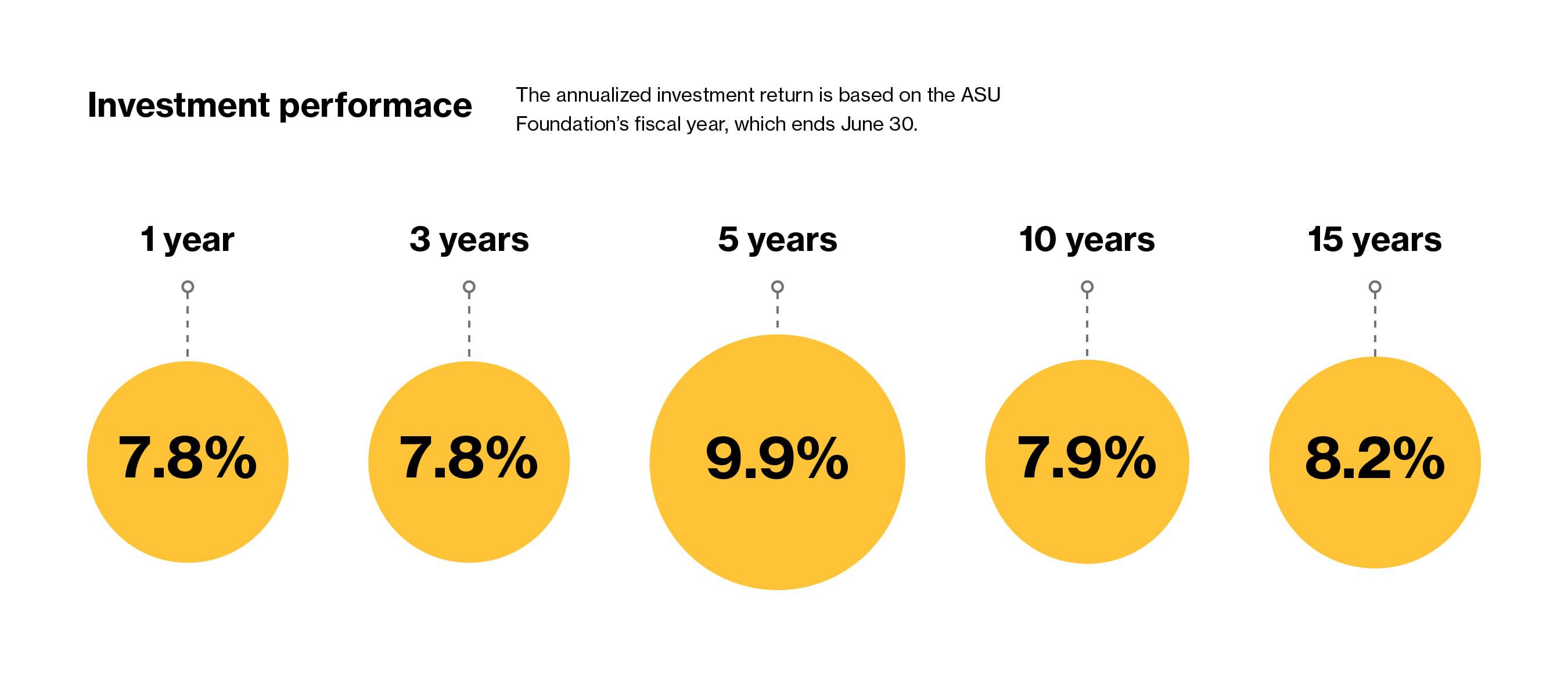

Each individual endowment account is invested in the larger ASU Foundation endowment pool, which affords opportunities for growth of both the endowment and perpetual annual payout. The ASUF endowment is professionally managed for long-term, stable growth with balanced investments across various asset types.

.jpg)

As an endowment donor, you're a vital part of ASU's continued success. Your contributions make scholarships, research, projects, and more possible, and we want to make sure you don't miss a thing. On ASU Link you can view your giving history, receive gift receipts and read endowment reports. Get started and see your impact by following the link below.

Meet the investment team

Our investment team works to steward your endowment and maximize its impact. Each year, we take a portion of your gift’s income and put it toward the cause designated, whether that be scholarships, athletics, research or special projects. These gifts make a difference in the lives of all ASU students and allow the university to continue its mission to uplift individuals and communities.

Frequently asked questions

What is an endowment?

How an endowment works

Why does a public university need an endowment?

Who decides how my endowment gift is used?

Is there a minimum gift size required to create an endowment?

Will my gift really make a difference to the ASU endowment?

Once established, may I continue to contribute to my endowment?

What documents are required to create an endowment?

How long before an endowment gift begins generating payout?

How much will my gift pay out to an ASU beneficiary?

What are the costs for managing and administering an endowment gift?

What is the governance and oversight of the endowment?

What is the investment strategy for the endowment?

Who should I contact if I have more investment questions?

Who should I contact with questions about the ASU Foundation Endowment?

Where can I view my endowment activity?

How do I log in to ASU Link to view my endowment online?