FAQs

Changing Futures

Changing Futures is Arizona State University’s comprehensive resource-raising campaign to shape a more sustainable, equitable and opportunity-rich world. It brings together ASU's global community to address some of society’s most urgent challenges — from education, leadership and health care to sustainability, technology and community resilience — through bold investment and collaborative action.

ASU launched this campaign because the world needs solutions — and ASU is uniquely positioned to deliver them. As a New American University, ASU is committed to redefining the role of higher education by being inclusive, impactful and innovative. The Changing Futures campaign is the next step in scaling that mission, ensuring ASU can accelerate academic excellence, expand access and fuel solutions that change lives and communities globally.

Participation can take many forms — giving, volunteering, sharing your story or championing the university’s mission in your community. Every gift, every action and every connection helps create impact. Whether you’re an alum, student, friend or partner, you can be part of this campaign by investing in the priorities that matter most to you and helping amplify ASU’s vision for a better future.

The Changing Futures campaign is focused on bold, measurable impact. It aims to reach 250 million learners worldwide, ensure every student can afford their education through scholarships and sustain $1.5 billion in annual research investment. It will drive innovation in six key areas: global education, leadership, the planet, health, community resilience and technology. More than numbers, success will be defined by the difference we make — in lives, in communities and in the future we create together.

Every gift made during the campaign — including one-time donations, recurring contributions, major gifts, estate gifts and corporate or foundation support — count toward the overall goal. Every contribution, no matter the size, is part of this collective effort to shape the future.

You can give online, by mail or by working with the ASU development staff to structure a gift that aligns with your philanthropic goals. Whether you're passionate about scholarships, sustainability, student success or scientific research, you can direct your support to the cause that inspires you.

Your gift will be strategically invested in the areas you choose to support. This could mean funding a scholarship, advancing medical innovation, protecting natural resources, expanding access to education or developing new technologies. The campaign is focused on real-world impact, ensuring your contribution creates meaningful change.

Your gift helps ASU do what it does best: challenge conventions, scale ideas and deliver solutions. From expanding access to education for first-generation students to launching breakthrough research, every contribution fuels ASU’s mission to serve its communities — locally and globally — and change lives for the better.

Giving site usage

Yes, you will be given the option to list your spouse or partner during the checkout process. In the “Your Contact Information” section, you will see optional fields to add your spouse or partner’s name to the gift.

You may create recurring, automatic gifts for one or multiple funds using various forms of payment. To create a recurring donation, select the “Recurring Donation” option button after adding that specific donation to your gift basket. Please note that if you select a recurring donation option, you will be required to create an ASU Link account.

Yes, you may make an anonymous gift. Please note that you will still need to provide your personal information so we can issue a receipt, but your gift will be acknowledged anonymously.

After clicking the “Complete Donation” button on the first checkout page, use the "Additional donation options" dropdown on the next page to check the box for an anonymous gift.

Yes, you may make a gift as a tribute to someone special during the checkout process. After clicking the “Complete Donation” button on the first checkout page, you’ll be taken to a second page where you can use the "My gift is a tribute" dropdown to select either “In Memory Of” or “In Honor Of.” You will be asked to enter details about the type of gift and the name of the person you are recognizing.

For gifts made in honor of someone, you will be asked to enter address information to notify them of your gift.

Yes, with matching gifts, it is possible to double or even triple your gift! Many employers sponsor matching gift programs and will match most charitable contributions made by their employees. Some companies even match gifts made by retirees and spouses, or award money to Arizona State University for volunteer hours. After clicking the “Complete Donation” button on the first checkout page, you’ll be taken to a second page where you will see a checkbox asking if your company will match your donation. Search for your company in our matching gift database. Learn more.

For assistance, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

Donor privacy and security is of paramount concern to us at Arizona State University.

- We have a team of dedicated security professionals who work on our systems every day to make sure they’re safe and protected from intrusion.

- We have encryption programs that allow us to store information in a way that is difficult to access.

- When we transmit data, we primarily do so internally and always in a secure way.

- We have a precise record retention policy so that we only maintain those records that are necessary.

- Finally, we maintain a careful system to adhere to the wishes of our donors as to if they want their information public or not.

More information about Donor Privacy is available here.

- Log into your ASU Link account.

- On the Pledges page in the Gifts section, choose an existing pledge and click the Edit button.

- On the Edit Recurring Gift page, enter a New Gift Amount, Frequency and/or End Date as desired.

- To cancel a recurring payment, check the box next to “Cancel this recurring gift” on the Edit Recurring Gift page under Additional Options and click the Save button.

For assistance, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

We accept all major credit cards, bank transfer (ACH), PayPal and Apple Pay as online payments. ASU and ASU Enterprise Partners employees also have the option to give via payroll deduction.

To give an immediate gift using a different method of payment, like a check or money order, please see: Ways to Give.

Login to ASU Link and go to the Recent Giving History page in the Gifts section. Here you will see a list of your gifts. Please note that you will not see information for gifts made prior to December 2020.

If you need further assistance, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

TA gift allocation code allows you to redeem funds with a specific monetary value. This code is found on a gift certificate (if you received one). During the checkout process, you may enter the code on the checkout page in the “Gift Allocation Code” section. If you do not have a gift certificate, please leave the field blank during checkout.

You may enter the gift code during the checkout process in the “Gift Allocation Code” section.

To find your tax receipt for an online transaction, click the person icon in the top right corner. Once you log in ASU Link, go to the Recent Giving History page where you will be able to view your tax receipts.

If you need further assistance, please contact Donor Relations at 480-965-2735.

There are two options for forgotten password assistance:

- If you normally log in with your ASURITE credentials, click the “Forgot ID / Password” link on the login screen and follow the instructions.

- If you normally log in with a non-ASU email address, click the “Forgot your password?” link on the login screen and follow the instructions.

Our new giving site is hosted on a new platform, ASU Link, and requires a new password. You may reuse your existing username and password credentials if you would like, but you will need to create a new password. If you used your asu.edu email address on the ASU Foundation site, log in to ASU Link using the ASURITE option.

ASU Link

If you are creating an account with an email address:

- Click “Activate Account” on the ASU Link login page.

- Enter your information on the Create Your Account screen and click “Submit”.

- You will be redirected to the ASU Link login page and see a message prompting you to confirm your account.

- Go to your email inbox and open the email titled “Welcome to ASU Link! Please verify your email.” and click “Verify My Email.”

- A new browser tab will open that shows the message, “Email verified! Please login below.” Click “Login with Email” and sign in using your email and password.

If you are affiliated with ASU and have ASURITE credentials, please create your account by following these steps:

- Click “Login with ASURITE” on the ASU Link login page.

- Enter your ASURITE User ID and Password, then click the “Sign In” button on the ASURITE Sign In page.

If you are logging in with an email address:

- Click the “Login with Email” button on the ASU Link login page.

- Enter your email and password, then click “Sign In.”

- You are now logged in to ASU Link.

If you are logging in with ASURITE credentials:

- Click the “Login with ASURITE” button on the ASU Link login page.

- Enter your ASURITE User ID and password, or Sign In with your Passkey if you have one.

- After completing Duo confirmation, you will be logged in to ASU Link.

Choose one of the following options for assistance with your ASURITE User ID or password:

- Use the ASU Lost/Forgotten Password Recovery service.

- Contact the ASU Help Desk.

- Call 855-278-5080.

Once you’re logged in, you can navigate ASU Link by selecting “ASU Link” in the top navigation bar. This opens a menu where you can access your personalized dashboard, account settings, payment information, giving history, and contact options.

- Go to the Account settings page in the Profile section.

- Click the Contact Information dropdown arrow.

- If you want to add a new email address, click the “Add New Email” link.

- If you want to add a new phone number, click the “Add New Phone” link.

- On the Pledges page in the Gifts section, choose an existing pledge and click the Edit button.

- On the Edit Recurring Gift page, change enter a New Gift Amount, Frequency and/or End Date as desired.

- Log into your ASU Link account.

- On the Pledges page in the Gifts section, choose an existing pledge and click the Edit button.

- On the Edit Recurring Gift page, check the box next to “Cancel this recurring gift” under Additional Options and click the Save button.

If you need assistance with editing a recurring gift, contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

If you want to change your preferred name:

- Go to the Account Settings page in the Profile section.

- Click the Personal Information dropdown arrow.

- Click the Edit link to enter a preferred name.

If you want to change your legal name, email donor.relations@asufoundation.org for assistance.

If you want to change your address:

- Go to the Account Settings page in the Profile section.

- Click the Address dropdown arrow.

- Click the Edit link to add a new mailing address.

You can add or edit your credit card or bank account information by going to the Payment Information page in the Profile section. To add a credit card or bank account, click on the “Add New Bank or Card” button to begin the process.

Adding a bank account gives you the option to submit payment for a gift by bank transfer (ACH). There are two methods to add and verify your bank accounts.

One method is to link with your financial institution. You can link an account instantly with approximately 5,000 financial institutions—representing more than 90 percent of bank accounts in the US.

The second method is to enter bank details manually. Through this method you use a highly secure process to enter your bank account details, then 1 -2 days later verify the transaction by confirming a micro-deposit to your account. After you verify the micro-deposit, the payment is completed and funds are debited from your account. To use this method, follow these steps:

Step 1: Select the “Add US Bank Account” option. Then select the link “Enter bank details manually instead”. Enter the routing number and the account number of your bank account.

Step 2: Watch your inbox for an email to arrive 1 – 2 days later with the subject line, “Verify your bank account for ASU Foundation”. This email includes a “Verify deposit” link and lets you know the micro-deposit has been made to your account.

Step 3: Access your bank account online (as you normally do) and find a deposit in the amount of $0.01 from ASU Foundation. In the memo/description line, look for the SM code. The code will start with “SM” and will be followed by four characters. Note: the four characters could be a combination of numbers and letters.

Step 4: Return to the “Verify your bank account for ASU Foundation” email. Click on the “Verify deposit” link in the email. Enter the SM code and click on the Verify button. If you have entered the SM code correctly you will see the message, “Thanks for your payment”.

Contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

Login to ASU Link and go to the Recent Giving History page in the Gifts section. Here you will see a list of your gifts. Please note that you will not see information for gifts made prior to December 2020.

The following gift types appear on the Recent Gift History page:

- ACH.

- Check.

- Credit Card.

- PayPal.

- Payroll Deduction.

- Personal Property (Gift in Kind).

- Real Property.

- Securities.

- Wire.

- Donor Advised Fund.

- Matching Gift (issued by a third party entity).

The following gift types do not appear on the Recent Gift History page:

- Matching Gift (issued by employer).

- Planned Gift.

If you need further assistance, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

- On the History page in the Gifts section, choose a gift and click the Receipt button.

- On the Receipt page, click the Download icon to the upper right of the receipt.

- Print the downloaded document.

- On the Endowment page in the Gifts section, click the View button under My Reports.

- On the My Reports page, select the fiscal year endowment report you want to see.

- On the page that displays the endowment report, click the Download icon to the upper right of the report.

- Print the downloaded document.

- On the Endowment page in the Gifts section, click the View button under My Reports.

- On the My Reports page, select the fiscal year endowment impact statement you want to see.

- On the page that displays the endowment impact statement, click the Download icon to the upper right of the statement.

- Print the downloaded document.

Your online gift is recorded right away, but it may take up to two business days to appear in your giving history. Once processing is complete, your gift will display automatically.

Gifts made to ASU by your company or organization do not appear in ASU Link. Also, matching gifts issued directly by an employer do not currently appear in ASU Link’s giving history. Contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

You have two options for viewing a list of your gifts for a calendar year: an Annual Gift Receipt and a Giving Statement.

- On the Recent Giving History page in the Gifts section, click the year of the giving history you want to see.

- Click either the “Annual Gift Receipt” or the “Giving Statement” View button.

- On the document page, click the Download icon to the upper right of the document to download a PDF.

- Print the downloaded document.

If you have questions, contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

The Annual Gift Receipt shows a list of gifts made to ASU during a calendar year that qualify for a gift receipt and may be considered tax deductible.

The Giving Statement shows a list of gifts made to ASU during a calendar year that may or may not be considered tax deductible. For example, an athletics seat contribution that is not considered to be tax-deductible by the IRS will appear on a donor’s Giving Statement.

The following transaction types do not qualify for a gift receipt and will be excluded from the Annual Gift Receipt in ASU Link:

- Soft Credits/Recognition Credits

- Matching Gifts

- Sun Devil Athletics Seat Portion Contributions

- Pledges without financial activity

- Grants without financial activity

Gifts made through a Donor Advised Fund may or may not appear on the Annual Gift Receipt.

Also, gifts of securities do not appear on the Annual Gift Receipt in ASU Link. To request an official gift receipt for Securities gifts, please contact ASU Foundation Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

Please consult with your tax adviser regarding the deductibility of your charitable contribution.

Login to ASU Link and go to the Sun Devil Club page in the Gifts section. If you are a Sun Devil Club member, you will see your member information, Priority Points Summary and Sun Devil Club Benefits in ASU Link.

You can also renew your Sun Devil Club membership in ASU Link by giving to a Sun Devil Athletics fund you have previously supported.

If you have questions about your Sun Devil Club membership, contact the Sun Devil Club at sundevilclub@asu.edu or call 480-727-7700 for assistance.

We plan to continue to expand and enhance ASU Link. Keep logging in to see how we are transforming ASU Link to create a greater experience for you.

Other types of gifts

Yes, you can send a check or money order made payable to the ASU Foundation and write the

supporting fund in the memo line.

Mail to:

ASU Foundation

Attention: Cash Receipting

P.O. Box 2260

Tempe, Arizona 85280-2260

If you need help finding the name of the specific fund to write in the memo, use the search bar at

the upper right of the webpage.

Yes, as an employee of Arizona State University or ASU Enterprise Partners, you can support ASU through regular gifts that are automatically deducted from your paycheck. You can make a gift through payroll deduction by logging in to ASU Link with your ASURITE credentials or by downloading the ASU Payroll Deduction Form.

Thank you for your interest in corporate and foundation gifts. To learn more about making a gift of this kind, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

An endowment gift is one of the most powerful ways you can support the future of ASU. An endowment is a gift of assets that is strategically converted by the ASU Foundation Endowment Fund into long-term investments to provide sustainable, long-term financial support. When you establish an endowment for the university, the investment provides sustainable financial support, helping us thrive for years to come. Learn more.

ASU Foundation information

The ASU Foundation is committed to financial transparency and accountability. To that end, information regarding our tax exempt status, our articles of incorporation, audited financial statements, and our IRS Form 990s are always available for public review here. For more information, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

For general information or to be directed to a specific department contact, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

Once you have created an ASU Link account, you can update your personal information on the “Account Settings” page. If you need assistance, contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735.

To opt out of our email communications at any time, please click on the unsubscribe link at the bottom of the email. If you would like to speak with someone instead, please contact Donor Relations at donor.relations@asufoundation.org or call 480-965-2735 for assistance.

At the ASU Foundation, we’re proud to be recognized for providing a one-of-a-kind environment that’s more than just a place to work. We’re creating a place where people can reach their potential. Explore our current career openings here.

Tax ID: 86-6051042

PitchFunder

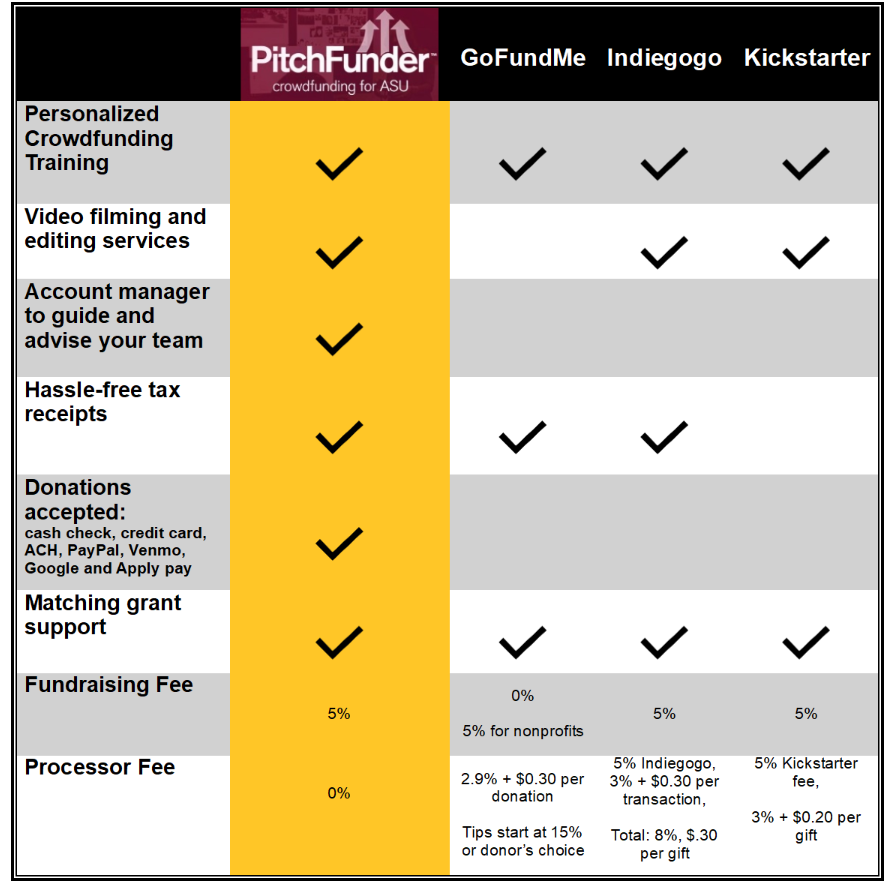

PitchFunder is a program from the ASU Foundation designed to empower the ASU community to raise charitable funds for ASU-related projects, research, events, and organizations.

Crowdfunding is a means of raising money by reaching out to your networks and inviting them to get involved with your project by making a contribution.

On average, a campaign is "live" for 30 days; however, we work with groups who require shorter or longer campaigns. The entire process takes about 3 months from start to finish.

Since donations to PitchFunder are gifts to the ASU Foundation, the funds are considered charitable donations. Supporters may benefit from tax-deductions, and you don't take on personal tax liability. 95% of each gift is directed to your campaign account, while 5% goes to advance ASU. Plus, PitchFunder provides training and personalized guidance for a successful campaign.

Groups that work best with PitchFunder are:

- Comprised of 5 or more members.

- Seeking $1,000–$10,000 for projects that benefit ASU students or the community.

- Willing to leverage personal networks to support the campaign.

- Available to commit 3 months to planning and executing the campaign.

Your team must apply to get started. PitchFunder staff will follow up to help determine your fundraising goal and prepare your campaign for success.

The larger your team, the more potential supporters you can reach. Most successful campaigns have 15–20 members or more.

- Set a realistic goal: Base your campaign goal on team size—most teams raise about $270 per person.

- Know your audience: Reach out to family, friends, mentors, professors, and others who care about your mission.

- Promote consistently: Use email (most effective), social media, texts, and in-person events like campus tabling.

- Use your resources: Stay in touch with your development officer, business operations manager, or department for support.

Before launching, you’ll need an ASU Foundation and university account. Once donations are made, funds are hosted by the ASU Foundation. You can access them by requesting a transfer through your Business Office Manager under ASU policy.

There are no costs to participate. 95% of donations go directly to your project account, and 5% supports ASU advancement. Even if you don’t reach your goal, you keep what you raise.