Your generosity. A world of impact.

Invest in the ideas, people and solutions shaping tomorrow.

As society faces the most complicated issues in recorded history, ASU’s Changing Futures campaign is shaping a world of opportunity, sustainability and transformation for people and communities everywhere.

Your support fuels access to education, groundbreaking research and innovations that challenge the status quo. The Charter Fund is your opportunity to power Changing Futures.

Together, we are standing up for the world we want and creating the society we want to live in.

This is our moment to change the future.

Invest in the ideas, people and solutions shaping tomorrow.

As society faces the most complicated issues in recorded history, ASU’s Changing Futures campaign is shaping a world of opportunity, sustainability and transformation for people and communities everywhere.

Your support fuels access to education, groundbreaking research and innovations that challenge the status quo. The Charter Fund is your opportunity to power Changing Futures.

Together, we are standing up for the world we want and creating the society we want to live in.

This is our moment to change the future.

Six bold commitments. One shared future.

Changing the world for the better

When you support Changing Futures, you:

- Transform global education by expanding access, enriching learning and empowering students in Arizona and beyond.

- Reshape our relationship with the planet by driving bold solutions to sustain our world and improve well-being for all.

- Empower community resilience by fueling ideas, partnerships and resources to build stronger, healthier communities.

- Build the future of health by advancing technology, supporting practitioners and expanding equitable health access.

- Inspire tomorrow’s game changers by empowering bold leaders to solve challenges and shape the future.

- Advance technology for good by fueling innovation that makes the future more inclusive and equitable.

Changing the world for the better

When you support Changing Futures, you:

- Transform global education by expanding access, enriching learning and empowering students in Arizona and beyond.

- Reshape our relationship with the planet by driving bold solutions to sustain our world and improve well-being for all.

- Empower community resilience by fueling ideas, partnerships and resources to build stronger, healthier communities.

- Build the future of health by advancing technology, supporting practitioners and expanding equitable health access.

- Inspire tomorrow’s game changers by empowering bold leaders to solve challenges and shape the future.

- Advance technology for good by fueling innovation that makes the future more inclusive and equitable.

Wherever you are in the world, whatever passion drives your giving, and however you choose to make your mark, you will find a way to contribute meaningfully through Changing Futures.

-

Your gift energizes the boldest and most ambitious global education initiative in higher education history.

-

When you give to the ASU Prep Digital Fund, you help prepare K-12 students for university success and encourage them to explore college majors and careers.

-

Your generosity has great impact at ASU and beyond.

-

With your gift, our team of faculty, staff, researchers and community leaders respond to priorities, urgent needs and emerging opportunities facing our world today.

-

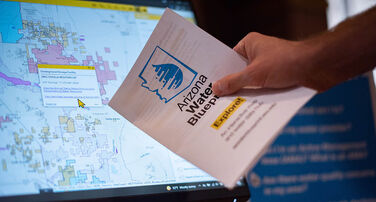

Your philanthropic support advances water policy and helps create a better water future for Arizona.

-

Your generosity has great impact at ASU and beyond.

-

Your generosity will support a program in which participants learn about crime and justice together through collaboration and dialogue.

-

The YouthMappers program cultivates a generation of young people to develop leadership abilities and create resilient communities around the world.

-

Your support of ASU has an impact locally, nationally and internationally.

-

Because of you, students pursue their dreams of becoming nurses, health care leaders, educators, policymakers and scholars.

-

From bench to bedside, your donation has a significant impact on the development of better diagnoses and treatments for cancer.

-

Your gift supports students and faculty.

-

Your generosity advances servant leadership among student-athletes and social impact through Sun Devil Athletics.

-

Your gift will provide scholarships and emergency aid for students in need.

-

You can honor our military veterans and give back to the men and women who bravely served our country.

-

Your gifts enable AI-driven technologies that support neurodivergent individuals.

-

Your generosity empowers world-class faculty and ensures that students within the information systems department have the resources they need to succeed.

-

ASU Women and Philanthropy inspires and empowers accomplished women to become visionary investors through a collective, significant force supporting Arizona State University

A bold new approach to impact

ASU is uniquely committed — and uniquely equipped — to make a difference. Repeatedly ranked No. 1 in innovation, sustainability and global impact, we have proven the transformative power of the New American University.

Right now, we cannot be bystanders. We can’t let the planet become unlivable, watch democracy fade or allow health to remain a privilege. We can’t miss the power of technology or the potential of the next generation.

We must go where we’re needed, connect people across the world and take bold action. Stand with us and help shape a better tomorrow.

ASU Foundation News

‘The time to change the future is now’

ASU establishes Center for Free Speech, will host annual free speech forum

Arizona couple donate $10M to Arizona PBS, the largest gift in the station's history

W. P. Carey Foundation commits $25M to ASU business school, bolsters real estate education

ASU Foundation celebrates 70 years of transformative impact

Gifts support science, students and society at ASU

$10.5M Knight Foundation grant launches Knight Center for the Future of News at ASU’s Cronkite School

ASU partners with biotech luminary to launch life science business program

Annual art exhibit by incarcerated community raises $18K for scholarship

ASU launches Work-Integrated Learning Accelerator with donor support

ASU Law launches Wolin Family Center for Intellectual Property Law

The power of purpose: ASU scholarships emphasize service to community

W. P. Carey School of Business celebrates new center and degree program for real estate, a vital industry for the state

$5 million gift to provide scholarships for new ASU medical school students

ASU+GSV Summit brings experts together to discuss innovation in education

‘The time to change the future is now’

ASU establishes Center for Free Speech, will host annual free speech forum

Arizona couple donate $10M to Arizona PBS, the largest gift in the station's history

W. P. Carey Foundation commits $25M to ASU business school, bolsters real estate education

ASU Foundation celebrates 70 years of transformative impact

Gifts support science, students and society at ASU

$10.5M Knight Foundation grant launches Knight Center for the Future of News at ASU’s Cronkite School

ASU partners with biotech luminary to launch life science business program

Annual art exhibit by incarcerated community raises $18K for scholarship

ASU launches Work-Integrated Learning Accelerator with donor support

ASU Law launches Wolin Family Center for Intellectual Property Law

The power of purpose: ASU scholarships emphasize service to community

W. P. Carey School of Business celebrates new center and degree program for real estate, a vital industry for the state

$5 million gift to provide scholarships for new ASU medical school students

ASU+GSV Summit brings experts together to discuss innovation in education

‘The time to change the future is now’

ASU establishes Center for Free Speech, will host annual free speech forum

Arizona couple donate $10M to Arizona PBS, the largest gift in the station's history

Transform global education

Transform global education Reshape our relationship with the planet

Reshape our relationship with the planet Empower community resilience

Empower community resilience

Build the future of health

Build the future of health Inspire tomorrow's game changers

Inspire tomorrow's game changers Advance technology for good

Advance technology for good